There are several metrics that a business relies on to measure its performance.

One of the most important ones is Customer Acquisition Cost (CAC), which informs a business about the tools and resources it spends on acquiring new customers. This metric helps a company determine the effectiveness of its marketing and sales efforts.

It’s crucial to manage CAC effectively to balance resources, enhance acquisition strategies, and boost revenue. This guide offers valuable insights to help you reach these goals efficiently.

Want to receive updates? Sign up to our newsletter

Each time a new blog is posted, you’ll receive a notification, it’s really that simple.

What Is Customer Acquisition Cost (CAC)?

Share of Customer acquisition cost, or CAC, can be defined as the total spend a business incurs in customer acquisition cost CAC over a fixed period of time. It includes the cost of all marketing and sales efforts to persuade a customer to purchase a product or service from the business.

Thus, the CAC includes all advertising expenses, salaries of sales and marketing employees, overheads, bonuses, etc., making it one of the most important metrics for determining whether a business is operating efficiently and profitably.

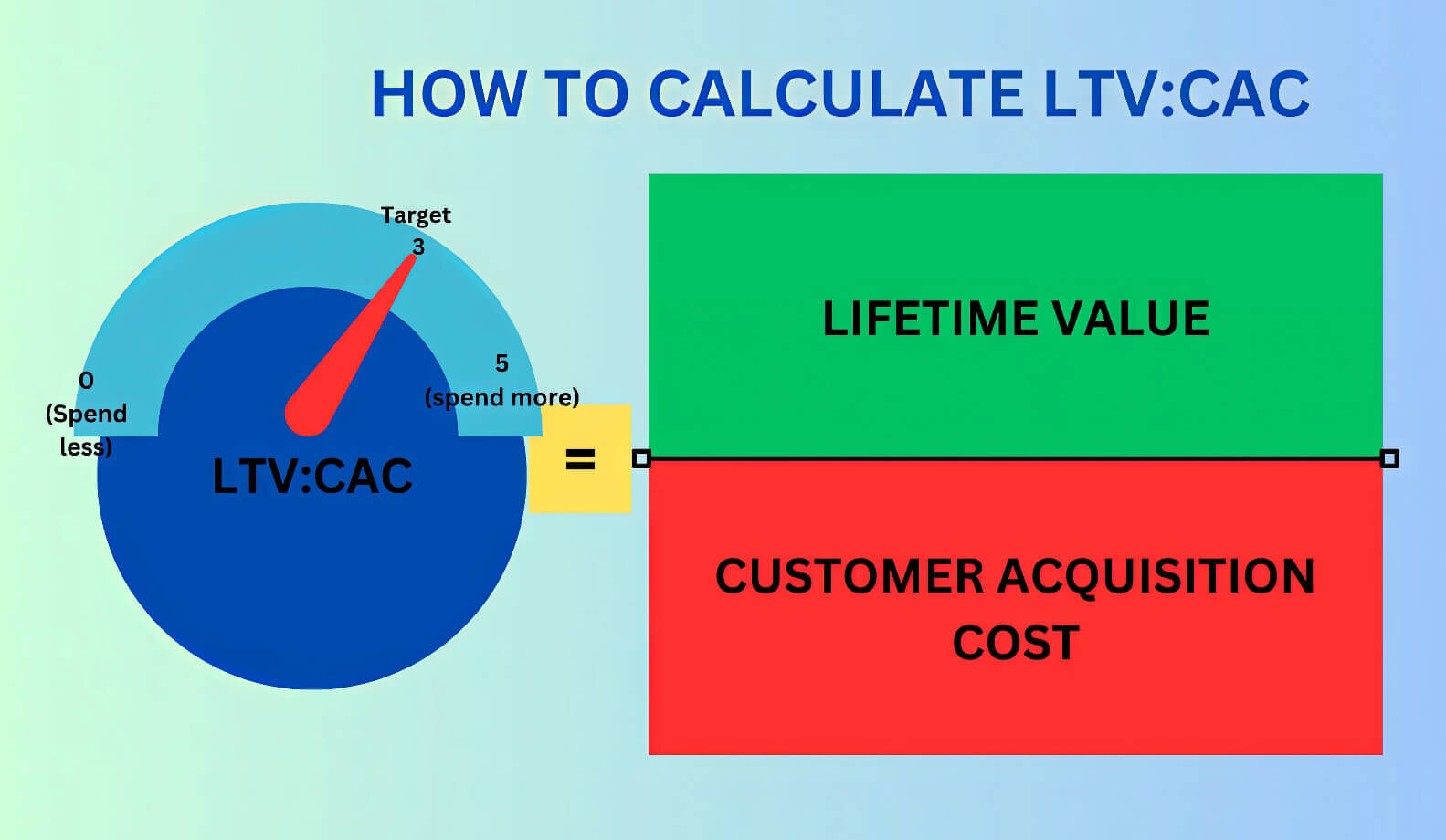

To fully understand CAC, it should be compared with Customer Lifetime Value (CLV), highlighting how valuable a customer is. If, over time, CAC exceeds the revenue generated, the business is spending more to acquire customers than it earns from them.

The Significance of Customer Acquisition Cost

The primary reason CAC is crucial for any business is that it indicates how successfully it can attract new users, especially those in the Software as a Service (SaaS) industry. Their marketing and sales teams put considerable work and resources into customer acquisition, but it can take a lot of time before any returns are seen.

With CAC, it is possible to measure whether allocating those resources to customer acquisition is justified or can be better used in another way. This can help attract more sales and enhance marketing efforts for the business model, assist in rationalising the budget for different objectives, and provide information regarding any inefficiencies in operation.

Upon determining your CAC, strategic actions can be employed to lower it, helping improve the marketing sales Return on Investment (ROI). However, one should not assume that CAC should be used in isolation; rather, it should be considered along with other factors, like CLV. This is because a business has to create customers and retain them, and customer retention is easier than customer acquisition.

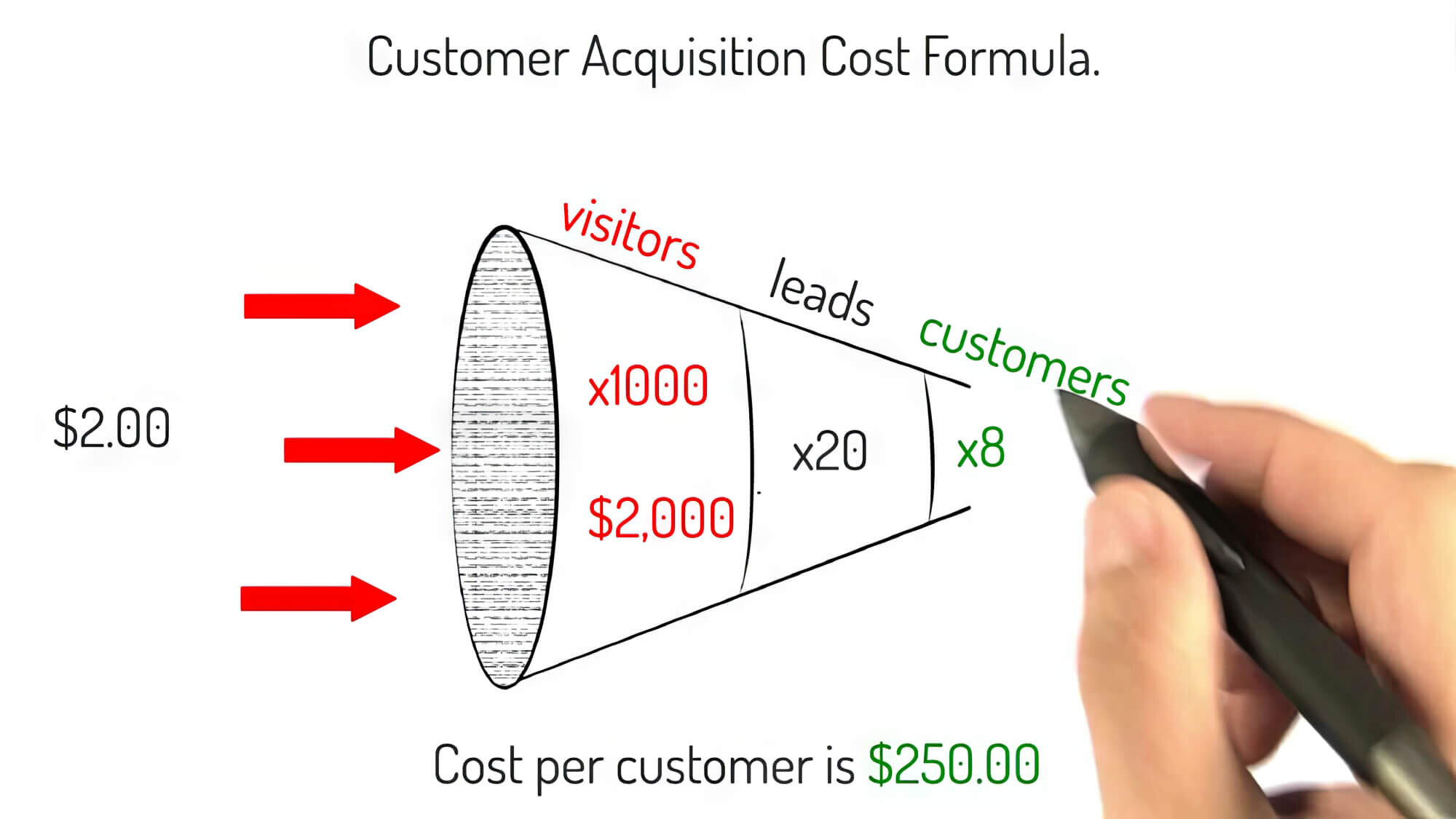

Calculating Customer Acquisition Cost

To calculate CAC, divide the total sales and marketing expenses over a set period by the number of new customers gained. This gives a clear measure of acquisition cost.

1. get started by deciding on a specific period

To calculate customer acquisition cost, you first need to specify the day or period for which it is to be ascertained. This period can be a quarter, a month, or even a year. Defining a specific period for which the CAC is to be calculated will help you know how much data is required for the purpose.

2. Add Up The Marketing And Sales Expenses

The subsequent steps involve totalling all incurred marketing and sales expenses for the determined duration. Marketing expenses can include the amount spent on digital and traditional ad campaigns, data collection expenses, including any software purchased for the purpose, subscriptions, salaries, and similar expenses.

Sales expenses generally include incentives for prospective customers, travel expenses, inventory upkeep, expenses on production technologies like software and salaries.

3. Divide The Added Expenses By The Number Of New Customers

After adding the marketing and sales expenses, the figure has to be divided by the number of customers acquired by the business in that period. The CAC formula used by businesses is as follows:

CAC = MCC/CA

MCC = Total Marketing Campaign Costs

CA = Total Customers Acquired

Once you have obtained the CAC, it can be compared with other metrics like the Lifetime Value to determine how optimally the business operates.

Customer Acquisition Cost Examples

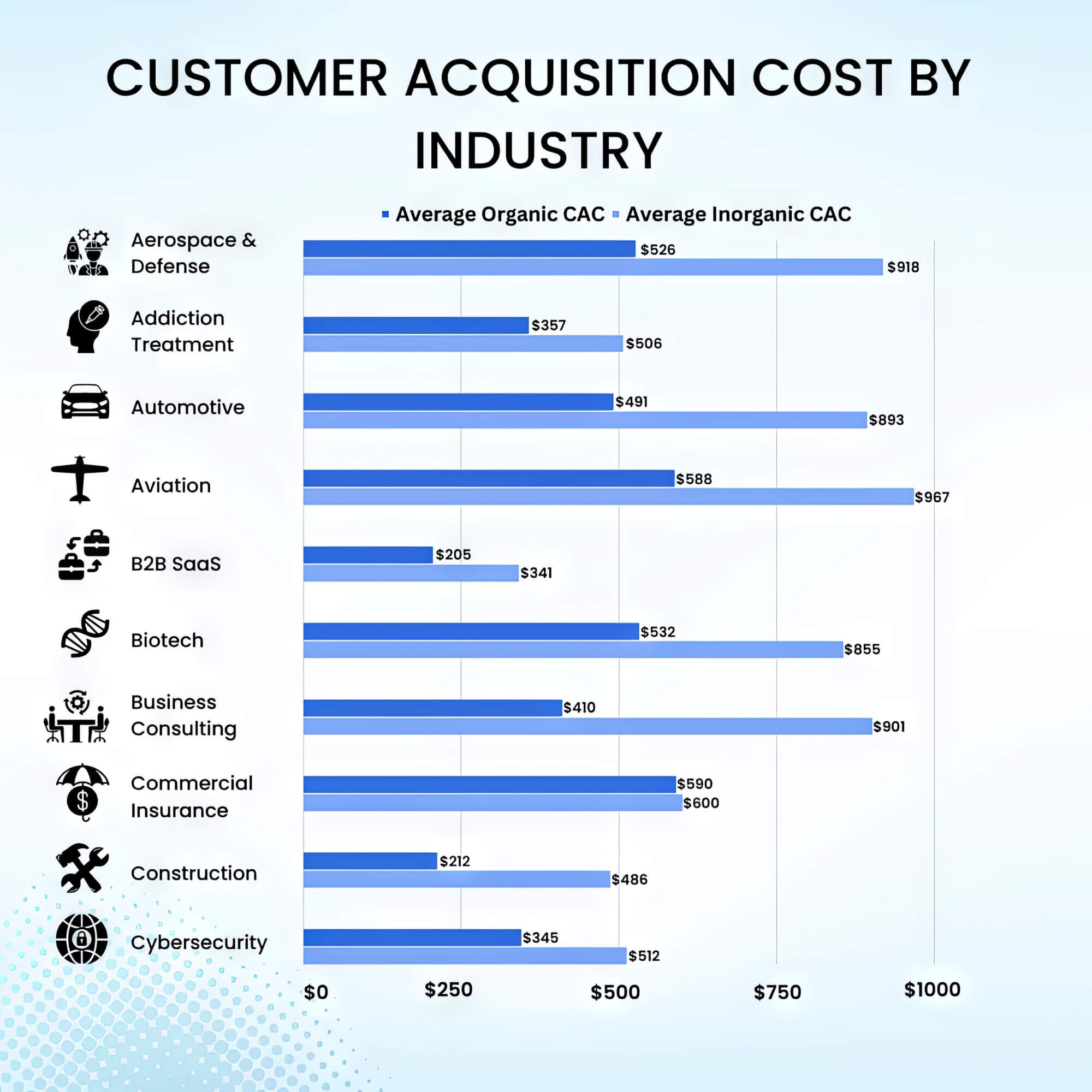

The following example demonstrates the calculation of CAC in various enterprise scenarios.

A. CAC For A Consumer Goods Manufacturer

For a consumer goods manufacturer that spends $2,000 on marketing and $4,000 on sales and gets 1,000 new customers, you can calculate customer acquisition costs as follows:

MCC = Total marketing campaign costs + cost of sales

$2,000 + $4,000 = $6,000

CA = 1000

CAC = 6,000/1,000 = $6

B. CAC For A Real Estate Company

Suppose a real-estate company spends $20,000 on marketing and $15,000 on sales and gains 70 customers after the campaign. In this case, by using the customer acquisition cost formula, the CAC can be determined as follows:

($20,000 + $15,000)/70 = $500

Why Is CAC Important For Businesses?

For a business, the ability to track CAC is extremely important for several reasons:

1. Profitability Impact

Customer acquisition costs directly impact the profitability of a company. If the CAC is too high, it can affect the business’s profit margins and lead to unsustainable account operations.

A high customer acquisition cost means that a significant portion of the revenue generated is spent at the start generated is spent on acquiring new customers, negatively affecting profitability.

2. Sustainable Growth

By controlling CAC, businesses can achieve sustainable growth. If the customer acquisition cost is properly managed and aligned with the Customer Lifetime Value (LTV), the business can expect profitable returns over the long run. This is especially crucial for startups and businesses hoping to grow while maintaining stability.

3. Investment And Resource Allocation

CAC helps businesses allocate and generate efficient marketing and sales budgets. It enables companies to identify the most efficient channels for customer acquisition, ensuring that resources are focused on strategies with the highest ROI.

4. Customer Lifetime Value (LTV) Optimisation

Understanding CAC allows businesses to optimise their LTV-to-CAC ratio. If the LTV exceeds CAC, it indicates the business is operating optimally and the revenue generated from customers over their lifetime exceeds the cost of acquiring them. Businesses can then focus on customer retention, considering the total number of customers they have and maximising the opportunities of each customer.

5. Competitive Advantage

Lowering CAC offers a competitive advantage in the market. Companies that can acquire new customers at a lower cost have more flexibility to offer competitive pricing, invest in innovation, or expand their customer base.

6. Efficient Marketing Strategies

To be able to reduce CAC, it is vital to have control and a proper understanding of the find target audiences and their preferences. This insight helps businesses tailor their marketing strategies and messages, leading to more efficient and effective campaigns.

7. Attracting Investors

Aiming for a good CAC can be very beneficial for startups and growing businesses looking for investments. Investors need to ensure the startup can acquire customers while keeping the sales and marketing expenses manageable. Low advertising costs and marketing spend can make the business attractive to potential investors.

Strategies To Reduce CAC

For any business to be viable, it has to ensure that the CAC is lower than the LTV, which can be achieved in the following ways.

1. Prioritise Organic Marketing

Organic marketing techniques, such as referral marketing, SEO, and article email marketing, can effectively drive customers to the business website without requiring any expenses, unlike paid marketing methods. Because of this, customer acquisition costs become significantly lower, and all the business needs to pay attention to are indirect costs that are part of the organic marketing techniques.

2. Focus On Customer Retention

As mentioned before, retaining existing customers is easier and more cost-effective than acquiring new ones. To do that, businesses can utilise customer relationship management systems, invest in better customer support, offer incentives like discounts and referrals and deliver personalised experiences through loyalty programmes.

3. Utilise Targeted Marketing

Marketing efforts should be improved to target the most relevant audience for specific products and services. This can be done by conducting market research and using data analytics to identify the ideal customer profile. Then, channels and campaigns that resonate with the target customers most effectively can be used.

4. Pay Attention To The Average Order Value

The Average Order Value (AOV) is the amount a customer spends on each order over a given period of time. A low AOV with a high CAC can indicate that the product prices are too low or that the business is spending a considerable sum on marketing and advertising activities. In such situations, increasing the prices can help reduce the CAC.

In addition, the AOV can be improved by cross-selling complementary products, bundling products or services, and offering free shipping.

5. Optimise Your Marketing Channels

Another excellent way to improve customer acquisition costs is to analyse the performance of various marketing channels to identify those that provide the best results at a lower cost. Businesses can allocate the marketing budget to the most effective channels while avoiding those that result in a high CAC.

6. Improve The Sales Conversion Rate

Improving sales processes is a great way to cut down on acquisition costs by turning leads into customers effectively. This involves streamlining the sales funnel, training your sales team well, and using customer feedback to refine methods.

7. Testing And Optimisation

Simple insights and learning derived from marketing campaigns should continue with testing and optimisation, along with ad creatives and landing pages, to improve conversion and customer retention rates. Various adjustments and tweaks can significantly impact the efficiency of your marketing efforts.

Measuring The Success Of CAC Optimisation Efforts

Measuring the effectiveness of CAC optimisation strategies is essential for businesses to understand the impact of their efforts on marketing efficiency, profitability and overall growth. Several metrics and indicators can be used to gauge the effectiveness of CAC optimisation strategies.

1. CAC To LTV Ratio

The CAC to LTV ratio is a critical metric that compares the cost to acquire a customer to the revenue generated from that customer over the period of interaction. Successful companies have a CAC-to-LTV ratio of less than one, which indicates that the average customer lifetime value exceeds the sales and marketing costs of acquiring them.

2. Customer Engagement Metrics

Monitoring customer engagement metrics like click-through rates (CTR), time on site, and page views can help assess the effectiveness of marketing campaigns. Improved engagement indicates that the target audience finds the content valuable and relevant, positively affecting customer acquisition costs.

3. Conversion Rates

Analysing conversion rates at different stages of the sales funnel can also help you know whether the money spent on gaining more customers is providing the desired outcome. Higher conversion rates indicate that acquisition costs are optimised, and various marketing tactics are attracting more qualified leads and more potential customers.

4. Marketing ROI

Calculating the ROI on each marketing channel or campaign to determine which strategies provide the best results can help optimise marketing costs and CAC. It can help businesses know which strategies are most effective in reducing the total cost of acquiring a new customer. Comparing the ROI of different channels can help identify the most cost-effective customer acquisition methods.

5. Customer Feedback And Satisfaction

Getting feedback from customers acquired recently can help businesses learn about their satisfaction levels and their overall experience with the brand. Satisfied customers are more likely to recommend the brand to others and become loyal followers, which can help reduce the costs spent on customer acquisitions.

6. Cost-Per-Lead (CPL)

Another way to measure the success of CAC optimisation efforts is to measure the cost-per-lead for each marketing campaign or channel. CPL is the average cost for every new lead gained in a campaign, and a lower CPL indicates that the business is acquiring customers more efficiently, leading to better optimisation.

7. Customer Segmentation

Analysing CAC across different customer segments can help identify the most cost-effective segments to acquire and retain. Such information can guide the business in refining targeting strategies and tailoring offerings according to specific segments, helping reduce unnecessary expenses and, thereby, the CAC.

FAQs

1. What are some cost-effective customer acquisition techniques for startups and small businesses?

For startups and small businesses with limited budgets, cost-effective customer acquisition techniques include content marketing, social media management, referral programmes and strategic partnerships.

Content marketing involves creating valuable and informative content, such as infographics, videos, articles, and blog posts. It can even be used to leverage social media platforms to engage with audiences directly. Then, there are referral programmes, which incentivise existing customers to buy and refer their friends, family, or colleagues to the business.

Businesses can utilise various SEO techniques to optimise the business website for search engines to improve organic visibility.

2. How does the average customer lifespan impact a SaaS company’s acquisition and overall business performance?

The average customer lifespan significantly impacts customer acquisition, business performance and profitability for SaaS companies. It guides acquisition strategies, customer relationships and support efforts. Longer lifespans lead to lower acquisition costs, stable revenue streams and better customer retention.

Understanding this metric helps optimise marketing and sales strategies, product development, and pricing. By focusing on customer satisfaction and loyalty, SaaS companies can build a sustainable business with strong customer relationships and increased profitability.

3. What factors should businesses consider when calculating CAC, and how do they affect overall profitability?

When calculating CAC, businesses should consider all costs involved in acquiring customers, such as paid advertising, employee salaries, and marketing expenses. To assess its impact on profitability, they must compare CAC with the average gross margin to determine if the acquisition efforts are cost-effective.

If CAC is lower than the average gross margin, it indicates a positive impact on profitability, as revenue from customers gained surpasses all the costs. However, if CAC exceeds the average gross margin, businesses must optimise their acquisition strategies to ensure sustainable profitability and a good ROI.

4. How can a SaaS business evaluate the impact of CAC on its profit margin and overall health?

To assess the impact of CAC on a SaaS business, it is important to consider the total expenses and business spending associated with acquiring new customers. The CAC will have to be calculated to determine its efficiency in relation to the profit margin.

By utilising acquisition teams and tracking net income through Google Analytics, businesses can analyse the effectiveness of their marketing efforts. Lowering CAC can lead to healthier profit margins, ensuring sustainable business growth and optimising overall business health in the industry.

5. How can a CRM system help businesses measure CAC and its impact on revenue?

A CRM or customer relationship management system can be instrumental in measuring CAC during a marketing campaign. Businesses can calculate CAC accurately by tracking acquisition expenses and customer spending through the CRM system.

Comparing CAC with the total sales revenue generated from the target audience during the same period provides insights into campaign effectiveness.

A well-integrated CRM system allows businesses to analyse the cost-efficiency of customer acquisition efforts, helping optimise marketing strategies and enhance revenue generation.

Crunching Your Business’s CAC

Customer Acquisition Cost (CAC) is a critical business metric that can profoundly impact a business’s financial health and long-term success. By understanding and actively managing CAC, companies can achieve sustainable growth, improve profitability and make data-driven decisions.

Continuously monitoring and optimising CAC ensures that resources are allocated optimally, marketing strategies are refined, and customer acquisition is efficient. In an ever-changing business landscape, a business must prioritise CAC optimisation while adapting to market dynamics and building strong customer relationships to survive.